LINK

Summary: Yesterday we examined the condition of the US economy. Today we look at a major driver of our prosperity, and what might be its long-term effects.

.

Contents

- How we got here

- What do we have to show from 5 years of massive stimulus?

- Why continue the stimulus?

- Putting the stimulus in perspective

- For More Information

- Another perspective

(1) How we got here

In December 2007 the US economy fell into recession. In February 2008 President Bush signed theEconomic Stimulus Act of 2008, with an estimated cost of $12 billion in 2008. Many such bills followed in the five years since then. The Fed pitched in, taking the Federal Funds rate from a peak of 5.25% in June 2006 to effectively zero in December 2008 (the ZIRP, Zero Interest Rate Policy) — where it remains today.

Plus there have been a wide range of other measures, conventional and unconventional, by various government agencies (eg, Treasury, FHA, SEC, Federal Reserve).

(2) What do we have to show from five years of massive stimulus?

(a) Since 2007 America has had one of the strongest economies in the developed world. This includes record high corporate profits, a slow steady rise in jobs, and rising incomes for the 1%. But it has not come for free; it cost $6.4 trillion in new Federal public debt since the recession started in December 2007. That’s a 225% increase in the debt, $1.2 trillion per year.

(b) The many powerful Fed actions, with few parallels in modern history for their magnitude and duration, have had a felicitous effect on profits of the Fed’s primary clients: the banks. Mission accomplished!

.

(c) Many conservatives have warned of a crippling rise interest rates, collapse of the dollar, inflation — or even hyperinflation (Weimar Germany and Zimbabwe figure prominently in their forecasts). No econometric model predicted these things; rather these dire forecasts were politically driven attempts to influence public policy. And so they’ve proven false, again and again. With, of course, no sign that these failures have sparked any learning or thinking by many conservative economists.

(d) Perhaps the least expected result is that the stimulus programs greatly reduced pressure for substantial reforms. We had the Great Recession but no New Deal. This break in our national learning mechanism might have great effects, such as allowing a repeat of the follies that brought on the great recession.

(e) The most common warning — loudly if irrationally disputed — concerns the many trillions of government debt we will have borrowed before the economy eventually returns to a normal state. It is a burden because we do not “owe it to ourselves”. We owe it to specific institutions and people, domestic and foreign. They will insist we pay it back, and deploy their vast political power to prevent its value being inflated away.

Worse, we’ve blown the money. Borrowing at low rates to rebuild America’s infrastructure would have been wisdom. Instead most of the money has disappeared along with the past five winters’ snows — leaving only the debt and our decaying infrastructure.

(f) What about the unknown effects? History has few precedents for such a wide range of government stimulus programs, done at such size, undertaken for so long. There might be severe economic effects, as yet unseen — becoming visible only slowly, or when the programs are ended. How have the stimulus programs distorted the normal working of the US economy? The immaturity of economic theory makes it a poor guide to such questions. We should expect the unexpected.

Afterwards economists will explain why these (now conjectural) ill effects were quite obvious. How could so much be borrowed — how could such low rates be maintained — how could the nation’s credit markets be manipulated (eg, now the government guarantees 80%+ of new mortgages) — without long-term ill effects?

We should fear the example of Japan. They fell into a slump in 1998 and, for reasons not understood, never recovered. Their prosperity continues only through massive government deficits and ZIRP. Fiscal and monetary stimulus might have become an addiction which they cannot break.

(3) Why continue the stimulus?

“The long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is past the ocean is flat again.”Many economists tell us the fiscal stimulus no longer drives GDP growth.; many say the same about Fed monetary programs (ZIRP, QE∞). We no longer need the stimulus, and just wait for an opportune time to drastically reduce it. While their math is of course correct, it ignores the effect of removing the stimulus (ie, its effect on the level of GDP).

— John Maynard Keynes, A Tract on Monetary Reform (1923)

Consider another form of addiction. Junkies often say “I don’t need the dope; I can stop at any time”. We can easily prove the junkies correct. Stop the drugs. Life will go on (for most chemical addictions). But only after an unpleasant period of withdrawal. The longer the drug use, the more difficult the withdrawal. Junkies seldom have the will to endure withdrawal without help. The same might be true of our stimulus programs. When the proper time comes, will we accept the possibility of withdrawal pains and wind down the stimulus programs?

Look at this from another perspective: if the economy is strong — as Wall Streets’ economists tell us — why continue these extreme monetary policies? Why continue to so slowly reduce the massive deficit? It’s not just to help the unemployed. There are more effective methods to do that — better for them and the nation. As a thought experiment, half of our trillion+ dollar deficit could employ all 13 million unemployed at $40 thousand gross per year (as an illustration, although impractical).

Perhaps our leaders continue the various stimulus programs because they suspect the hidden weakness of the US economy. They talk positively to manage expectations. Information management, managing expectations — spin and lies have become an increasingly large aspect of many departments of government. Civilian and military. It’s the way a weak, foolish people are ruled.

(4) Putting the stimulus in perspective

We have been taught — or trained — to believe ourselves exceptional, so that Americans need not look to other nations for lessons. That’s a bulwark supporting our mad public policies in many fields, such as national security, education, and health care. A look at our more successful peers, such as those in Northern Europe, would shatter our preconceptions and sense of superiority.

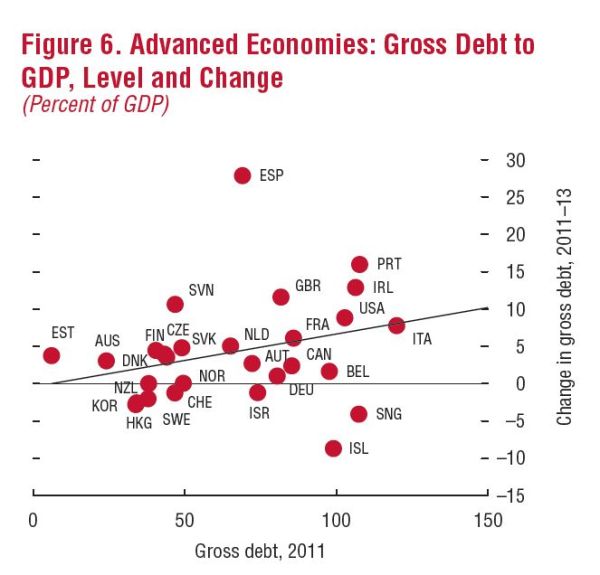

So it is with some aspects of our economic policy. This graphic from the IMF’s Fiscal Monitor of October 2012 puts the US on the inefficient frontier along with Ireland, Italy, Spain, and Portugal. We’re not in good company. Following us (below and to the left) are Great Britain — perhaps now re-entering recession — plus France and Belgium (the weakest nations in Northern Europe).

(5) For More Information

Posts about fiscal stimulus programs:

- Everything you need to know about government stimulus programs (read this – it’s about your money), 30 January 2009

- Government economic stimulus is financial heroin, 28 December 2009

- Our government’s finances are broken. How do we compare with our peers?, 8 April 2010

- Capitalism Lost: America goes broke because we forgot how to be capitalists, 24 May 2012

- America is rich and powerful because we can borrow. Will this debt build a stronger America?, 5 June 2012

- US economic update. Everything that follows is a result of what you see here., 8 June 2012

- The Fed is not wildly printing money, as yet no hyperinflation, we’re not becoming Zimbabwe, 2 March 2010

- Important things to know about QE2 (forewarned is forearmed), 21 October 2010

- Bernanke leads us down the hole to wonderland! (more about QE2), 5 November 2010

- Inflation is coming! Inflation is coming!, 7 February 2011

- Inciting fear of inflation in our minds for political gain (we are easily led), 28 February 2011

- Update on the inflation hysteria, the invisible monster about to devour us!. 15 April 2011

- Explaining the gold standard, the Euro, Default, Deflation, and Hyperinflation, 17 December 2011

- What every American needs to know about the Federal Reserve System, 31 March 2012

- What are the limitations of the Fed’s power? It’s neither impotent nor omnipotent!, 17 February 2012

- The lost history of money, an antidote to the myths, 1 December 2012

This piece is cross-posted from Fabius Maximus with permission.

Comment:

" But it has not come for free; it cost $6.4 trillion in new Federal public debt since the recession started in December 2007. That’s a 225% increase in the debt, $1.2 trillion per year." Treasury states debt on Dec. 2007 was $5.146 trillion, and $11. 560 on Jan 31, 2013. That's a 125% increase. Adjusted for inflation it is 103%. Double. Didn't 15 million workers lose their jobs, and half were rehired, 8.875 permanently displaced according to the BLS. And now about 6.1 million private sector jobs were created since the private sector employment trough in Feb. 2010. Still, compared to April 2001, private sector jobs have increased by 1.0% to be exact, 1,185,000 more than 12 years ago. The working age population increased by 14.6%. When the economy that is 70% driven by purchasing demand, a major drop-off will result, i.e., a gap in former potential vs. actual. We're about 6% below full potential, about $1 trillion in lost output. The self-generating expansion has not arrived, and it will not until sufficient government stimulus re-ignites private sector hiring. We need a full employment policy. Between 1933-1937 unemployment dropped from 25% to 9.6% (Marshall Auerback's article at Next New Deal, August, 2011, The Real Lesson from the Great Depression: Fiscal Policy Works, http://www.rooseveltinstitute.org/new-roosevelt/r...

We need to reflate demand. We need to balance the out-of-balance distribution of income. We are in an inequality trap. See Polly Cleveland's article at Dollars and Sense: http://dollarsandsense.org/blog/ -- my blog: http://benL8.blogspot.com

We need to reflate demand. We need to balance the out-of-balance distribution of income. We are in an inequality trap. See Polly Cleveland's article at Dollars and Sense: http://dollarsandsense.org/blog/ -- my blog: http://benL8.blogspot.com

2 comments:

Teraz biura rachunkowe nie muszą upominać się na małą ilośc zainteresowanych.

Przychodzą do takich głównie właściciele firm, którzy założyli jednoosobowe

firmy. Takich osób jest obecnie na rynku naprawdę dużo.

Zarządzając oraz obsługując samodzielnie działalność gospodarczą, nie można raczej o wszystko zadbać osobiście.

Dlatego też korzystają oni z usług zaoferowanych na rynku, które okazują się doskonałym wyjściem.

Jedną z dziedzin, która obsługuje takie działalności gospodarczej jest

właśnie rachunkowość proponująca propozycje księgowe, jaka musi czuwać na zgodnością finansów w firmie.

My site > biuro rachunkowe Extor

Lloyd,

Yes! You have thought about this! I shouldn't be surprised. I'm quoting from your post:

~"Perhaps the least expected result is that the stimulus programs greatly reduced pressure for substantial reforms. We had the Great Recession but no New Deal."

That is very bad. I too am concerned that we've failed to learn from our mistakes, and that the next downturn will be much more severe. I don't think there was ill-intent by Chairman Bernanke, nor former President Bush. I was willing to believe similarly about President Obama. Recently, I am uncertain. I am a registered Democrat, so it hurts me to feel this way. FDR is my hero, a great, good leader.

The worst problem with the debt we've taken on, beyond even its magnitude, is this:

~"...we’ve blown the money. Borrowing at low rates to rebuild America’s infrastructure would have been wisdom. Instead most of the money has disappeared along with the past five winters’ snows — leaving only the debt and our decaying infrastructure."

I'm so scared.

Post a Comment